Czech Lex Brexit.

Legalization of residence of United Kingdom citizens in the Czech Republic in case of so-called hard Brexit.

Czech Act on Brexit. Czech Brexit Law

Deal scenario

The Withdrawal Agreement anticipates a transition period lasting until December 31, 2020, with the possibility to extend it until the end of 2022. It assumes that the UK citizens living in the Czech Republic will maintain and enjoy the rights that EU nationals have today in order to live, travel, work and study.

No Deal Scenario

Without an explicit legal regulation of transition procedure (the so-called Brexit national legislation, the Czech Brexit Law or the Czech Brexit Act), British citizens residing in the Czech Republic would, in the absence of an agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union, find themselves in the same position as other foreigners from so called third countries outside the European Union. This would result in a number of fundamental changes, as these UK citizens would automatically be treated as third country nationals without the privileges guaranteed to the citizens of the European Union. In particular, for example, they would lose free access to the Czech labour market and cease to be participants of the health and social system of the Czech Republic. Such situation would threaten roughly 5,000 British citizens operating on the Czech labour market from a total of approx. 8,000 British citizens residing in the Czech Republic. At the same time, the absence of legislation could also directly threaten the position of some 40,000 Czech citizens in the United Kingdom, because if the Czech Republic did not respond reciprocally to the offer of guarantees for the rights of EU citizens in the United Kingdom, the conditions for Czech citizens in the United Kingdom could be tightened. The British Government offers all Czech (and European) citizens residing in the UK on the Brexit Day right to automatically reside and work on grounds of a valid identity document and that being until December 31, 2020 which is the deadline for Czech (European) citizens to apply for settled status.

The abovementioned situation was prevented by the Czech Brexit Act, which has been published in the Czech Collection of Laws on March 14, 2019. The Czech Ministry of Interior published already an unofficial English translation of the Czech Brexit Act (Act On Amending Certain Matters in Connection with the Withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union).The legislation is in principle temporary and these special measures will only apply until the conclusion of the Withdrawal Agreement, but no later than by December 31, 2020. If this deadline is not met, then the Czech Brexit Act expires and the status of the UK citizens will be governed by the generally applicable rules for third-country nationals.

The Czech Brexit Act regulates in particular:

a) residence of a United Kingdom national, or a family member of a United Kingdom national, in the territory of the Czech Republic,

b) obtaining of the Czech citizenship by a United Kingdom national,

c) getting a marriage or civil partnership by a United Kingdom national and a married name declaration,

d) access of a United Kingdom national or their family member to the labour market and their entitlement to unemployment benefits,

e) provision of some social security benefits and carer’s benefit to a United Kingdom national or a family member of the United Kingdom national,

f) income tax in relation to the United Kingdom,

g) building savings of a United Kingdom national,

h) supplementary pension schemes with contributions from the state and additional pension savings of a person with a place of residence in the territory of the United Kingdom,

i) payment transactions in pounds sterling and payment transactions using payment services in the United Kingdom,

j) recognition of professional qualifications of a United Kingdom national or a family member of a United Kingdom national,

k) recognition of professional qualifications and specialized skills for medical professions and for performing of activities relating to healthcare obtained in the territory of the United Kingdom,

l) provision of legal services by a United Kingdom national,

m) tax consulting provided by a United Kingdom national, or a family member of a United Kingdom national,

n) provision of financial services licensed in the United Kingdom,

o) provision of foreign higher education by a foreign higher education institution with registered office, central administration or the principal place of business in the United Kingdom, or by a higher education institution established pursuant to the laws of the United Kingdom (hereinafter referred to as “the foreign higher education institution based in the United Kingdom”), or by its Czech branch,

p) treatment of medicinal products manufactured or released in the United Kingdom,

q) public money collections organized by a legal entity based in the United Kingdom,

r) position of an entity with a registered office in the United Kingdom in the matters relating to gambling.

Residence of a United Kingdom citizen or his/her family member in the Czech Republic

Temporary residence of a UK citizen in the Czech Republic

A UK citizen who has been issued a certificate of temporary residence in the Czech Republic prior to the date of entry into effect of the Czech Brexit Act and whose temporary residence has not been canceled or expired prior to the effective date of the Act will be entitled to stay temporarily in the Czech Republic. Similarly, a UK citizen who, before the date of entry into effect of the Brexit Act, has filed a request for a temporary residence permit to be issued in the Czech Republic that has not been finally resolved prior to the entry into effect of the Czech Brexit Act, is entitled to stay temporarily in the Czech Republic until the decision on the application becomes final and subsequently after the date of granting the temporary stay.

At the request of the UK citizen, the Czech Ministry of the Interior will issue a certification of submission of an application for a temporary residence permit in the Czech Republic.

Temporary residence of a family member of a UK citizen in the Czech Republic

A UK citizen's family member means a person who, at the date of entry into effect of the Czech Brexit Act in relation to a UK citizen, fulfills the conditions set out in Article 15a of the Aliens Residence Act in the Czech Republic. The temporary stay of a family member of a UK citizen in the territory of the Czech Republic is regulated in the same manner as that of a UK citizen.

Application for the issuance of a long-term or permanent residence permit in the Czech Republic

A UK citizen is entitled under statutory provisions to apply for a residence permit directly within the territory of the Czech Republic without the need to leave the territory to apply at a locally competent embassy of the Czech Republic abroad. Moreover, in the case of UK citizens applying for permanent residence permit under Section 68 of the the Aliens Residence Act in the Czech Republic, a document proving knowledge of the Czech language will not be required.

Acquisition of Czech citizenship by a UK citizen

A UK citizen who, before the date of entry into effect of the Czech Brexit Act, filed an application for Czech citizenship, decision on which has not yet become final by the date of entry into effect of the Czech Brexit Act, is considered to be an EU citizen for the purposes of assessing the fulfillment of the condition of permanent residence in the Czech Republic.

Access to the Czech labour market and unemployment benefits of a UK citizen or his/her family member

A work permit, employee card, in-house card or blue card is not required for employing a UK citizen or his/her family member whose employment relationship under the Labour Code was established prior to the entry into effect of the Czech Brexit Act. The period of insurance, employment or self-employment acquired in the United Kingdom under Regulation (EC) No 883/2004 of the European Parliament and of the Council on the coordination of social security systems, as amended, as of the date of entry into effect of the Czech Brexit Act, is, for the purpose of meeting the condition under Article 39 (1) (a) of the Czech Labour Code considered to be a previous employment.

Unemployment benefit granted to a UK citizen or a UK citizen's family member before the date of entry into effect of the Czech Brexit Act, where a UK citizen or a member of the UK citizen has applied in accordance with Article 64 of Regulation of the European Parliament and the Council (EC) No 883/2004 on the granting of unemployment benefit to the United Kingdom will be granted in the United Kingdom.

Payment of certain Czech state social support benefits and care allowance to a UK citizen or his/her family member

The entitlement of a United Kingdom citizen or a UK citizen's family member to be paid parental allowance before the date of entry into effect of the Czech Brexit Act remains unchanged, but until the total amount has been paid for parental allowance for the care for the same youngest child in the family.

The entitlement of a UK citizen or his/her family member to be paid child allowance and care allowance which arose prior to the date of entry into effect of the Czech Brexit Act remains unchanged until the Czech Brexit Act expires.

Income taxes in relation to the United Kingdom

A taxpayer who is a UK tax resident is considered to be a tax resident of a Member State of the European Union for the purposes of the tax liability for the tax period in which the Czech Brexit Act becomes effective; this does not apply to withholding tax according to the special tax rate and to tax apprehension. For the purposes of the income tax liability of a taxpayer who is not a United Kingdom tax resident, the United Kingdom shall be regarded as a Member State of the European Union by the end of the tax period in which the Czech Brexit Act expires.

Recognition of professional qualifications of a UK citizen or his/her family member

A UK citizen who, before the date of entry into effect of the Brexit Act, filed an application for recognition of professional qualifications under the law regulating recognition of professional qualifications, decision on which had not yet become final by the date of entry into effect of the Brexit Act, is considered a citizen of the European Union for the purposes of this procedure.

A family member of a UK citizen who, prior to the date of entry into effect of the Brexit Act, filed an application for recognition of professional qualifications under the law regulating recognition of professional qualifications decision on which had not yet become final by the date of entry into effect of the Czech Brexit Act is considered a family member of a EU citizen.

Explicit equalization in other areas of business

The Czech Brexit Act contains a further explicit adjustment to the equal status of UK citizens with EU citizens in the Czech Republic, inter alia, in the area of building savings schemes, state-subsidized supplementary pensions and supplementary pension savings, UK pound payment transactions and payment transactions using payment services in the UK, the recognition of professional competence and specialized competence in the exercise of the medical profession and the exercise of healthcare-related activities acquired in the United Kingdom, provision of legal services by a UK citizen, provision of tax advice to a UK citizen or member of a UK citizen's family, provision of financial services under a UK authorization, the provision of foreign higher education by a foreign higher education institution which has its registered office, central administration or principal place of business in the United Kingdom or has been established under UK law or its domestic branch, a public collection held by a legal entity established in the United Kingdom, position of a person established in the United Kingdom in the field of gambling.

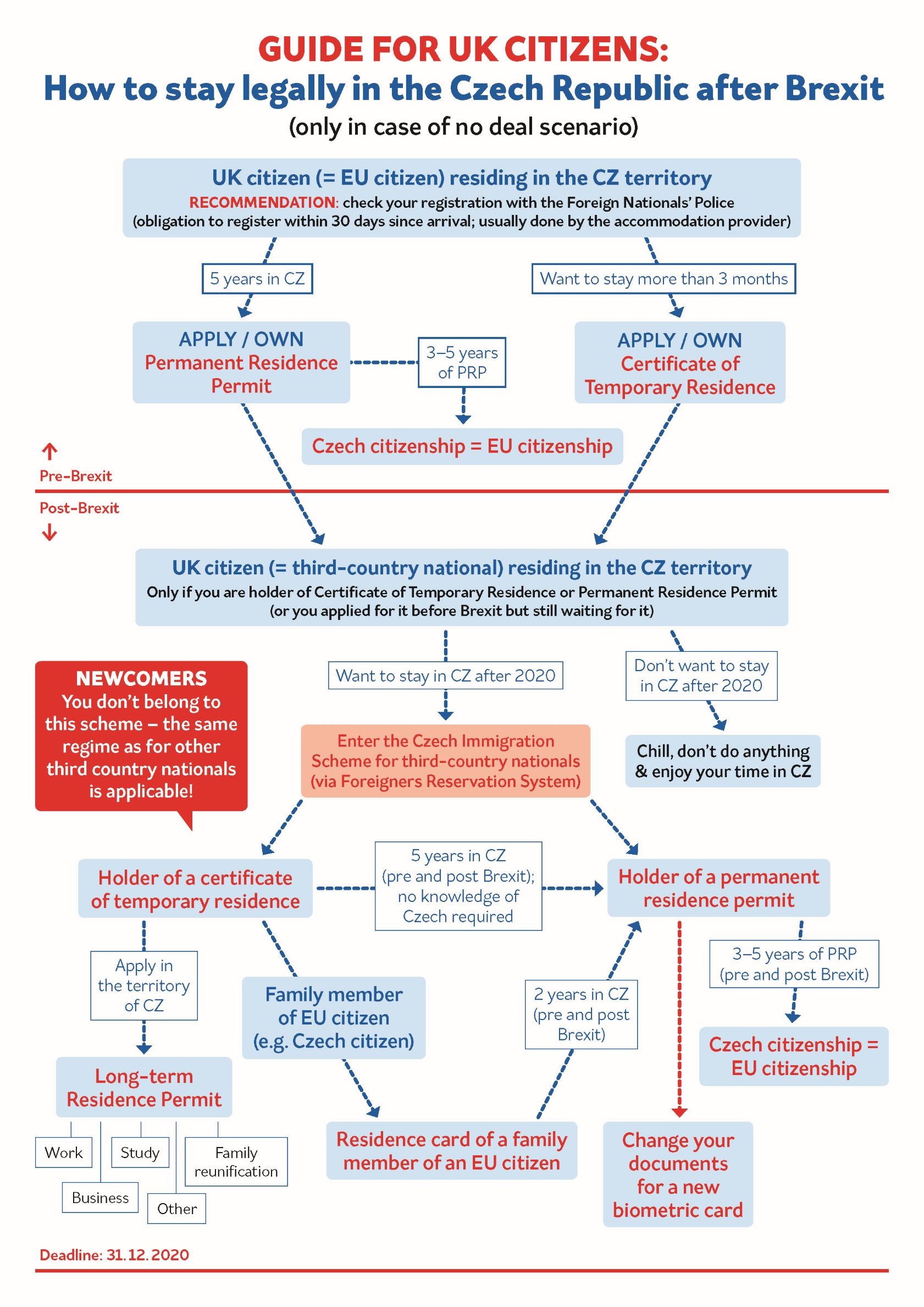

Czech Brexit Map for UK citizens

The Czech Ministry of Interior prepared also a Brexit Map for UK citizens:

A lot of useful practical information can be also found at the web page BREXITINFO.CZ or at Brexit: Questions and Answers from Government of the Czech Republic or at web page of Czech Ministry of Interioror at GOV.UK: Guidance

Living in the Czech Republic.

For more information, contact us at:

JUDr. Mojmír Ježek, Ph.D.

ECOVIS ježek, advokátní kancelář s.r.o.

Betlémské nám. 6

110 00 Praha 1

e-mail: mojmir.jezek@ecovislegal.cz

www.ecovislegal.cz

About ECOVIS ježek advokátní kancelář s.r.o.

The Czech law office in Prague ECOVIS ježek practices mainly in the area of Czech commercial law, Czech real estate law, representation at Czech courts, administrative bodies and arbitration courts, as well as Czech finance and banking law, and provides full-fledged advice in all areas, making it a suitable alternative for clients of international law offices. The international dimension of the Czech legal services provided is ensured through past experience and through co-operation with leading legal offices in most European countries, the US, and other jurisdictions. The Czech lawyers of the ECOVIS ježek team have many years of experience from leading international law offices and tax companies, in providing legal advice to multinational corporations, large Czech companies, but also to medium-sized companies and individual clients. For more information, go to www.ecovislegal.cz/en.

The information contained on this website is a legal advertisement. Do not consider anything on this website as legal advice and nothing on this website is an advocate-client relationship. Before discussing anything about what you read on these pages, arrange a legal consultation with us. Past results are not a guarantee of future results, and previous results do not indicate or predict future results. Each case is different and must be judged according to its own circumstances.