From Lithuanian crypto exchanges to the Czech market: the impact of the new MiCA regulation on providers and investors

In this article, we provide you with a general overview of the regulation of cryptoassets in the European Union, Lithuania and the Czech Republic. We have prepared this article in cooperation with our colleagues from the Lithuanian law firm ECOVIS ProventusLaw and the original article in English can be found here.

Current European national legislation in the field of regulation of crypto-assets and the MiCA Regulation

The recently adopted European Cryptoassets Markets Regulation (the "Regulation" or "MiCA") has established a pan-European regulatory framework for cryptoassets, including a passporting license for cryptoasset service providers (CASPs) and authorization for certain cryptoasset issuers throughout the European Union and the European Economic Area (EU/EEA). However, European national licenses for virtual asset service providers (VASPs) will remain in force until the full implementation of MiCA at the end of 2024.

Types of national crypto asset service provider authorisations

Currently, EU Member States mainly grant 2 types of CASP authorisations:

Crypto Asset Exchange Operator - for FIAT to Crypto Asset, Crypto Asset to FIAT and Crypto Asset to Crypto Asset exchange services.

Cryptoasset Wallet Operator - for custody of crypto-virtual assets and management of clients' crypto-asset wallets.

The type of permit may vary depending on the country. Some jurisdictions require separate authorisations for the issuance of cryptoassets (tokens/coins) and related processes (ICO, IEO) and for the provision of cryptoasset services.

Companies that currently hold VASP authorisations in EU/EEA countries are subject to supervision by national AML and financial regulatory authorities in the countries where they are registered.

What to consider when selecting a European jurisdiction for VASP authorisation before implementing MiCA:

- Company formation and share capital requirements

- Requirements for local presence in the country of incorporation and employment of a local AML officer/MLRO

- Ability to open a bank account/EMI for the company

- Client acceptance, KYC and AML reporting requirements

- Regulatory reporting and company maintenance costs

Poland, for example, is an attractive jurisdiction for VASP authorisation as there are no additional capital requirements.

On the other hand, Lithuania is attractive due to the wide range of licensed financial institutions that are friendly to crypto companies and offer bank accounts/EMI accounts for crypto companies. This is important because it is usually easier to raise capital than to establish a reliable business infrastructure and find crypto-friendly financial institutions.

Authorization of Lithuanian crypto exchange and crypto wallet service provider

Lithuania is widely recognized as a traditional financial jurisdiction for payment and e-money institutions in Europe and has become one of the most popular jurisdictions in Europe for crypto companies as well. Lithuania is one of the few countries in the European Union and European Economic Area (EU/EEA) that offers a transparent and cost-effective national crypto exchange and crypto wallet operator authorization.

Lithuanian national regulation of cryptoassets is currently considered one of the most favourable in the European Union, as it allows the provision of cryptoasset-related services in other European markets. The simplicity of the procedures for obtaining a cryptoasset license in Lithuania and the speed of obtaining a license are just some of the most significant advantages of obtaining a cryptoasset license in Lithuania.

This is why Lithuania has attracted the world's largest crypto exchange Binance. ECOVIS advised Binance throughout the process, which included, among other things, matters related to the establishment and licensing process. As a result, with the help of ECOVIS, Binance currently has a Lithuanian license to operate a crypto exchange and crypto wallet custody from mid-2020.

Furthermore, Lithuanian companies with a VASP permit can obtain VASP permits in other European countries such as Germany, Italy, France and Spain under the same Lithuanian registered company and without establishing additional companies/branches in other European Member States. Company capital, employed staff and local bank accounts opened in Lithuania can be used for business operations in all other major European national markets, saving business costs.

General requirements for a VASP in Lithuania

Before the MiCA Regulation harmonises the requirements for cryptographic activities, national requirements may differ. However, there are some general requirements for entities carrying out VASP activities in Lithuania that are common in other jurisdictions:

- Reporting to the Lithuanian Financial Intelligence Unit

- Maintenance of records and client data

- Compliance with the requirements for presence in Lithuania and employment of an anti-money laundering officer

- AML/KYC policies and internal control procedures in place

- Board members, as well as the ultimate owners of the company, must meet the integrity requirements.

- Directors and board members are not required to be Lithuanian/European residents. MiCA at a glance

Cryptoassets in the Czech Republic

Cryptoassets are very popular in the Czech Republic, with cryptoassets traded in the amount of CZK 3.45 billion from January to December 2023, an increase of almost 5% compared to 2022.

However, the Czech Republic does not have specific legislation regulating cryptoassets and trading with them. Nevertheless, companies providing services with cryptoassets are subject to anti-money laundering regulations, and transactions with cryptoassets are subject to capital gains tax.

According to §489 and §496 of the German Civil Code, cryptoassets are intangible assets. The only definition of cryptoassets as a virtual asset is contained in Act No. 253/2008 Coll. on certain measures against the legalization of proceeds of crime and terrorist financing, as "a transferable unit that is capable of performing a payment, exchange or investment function, regardless of whether it has an issuer or not". However, this definition is only binding for the purposes of this law.

The European regulation and its implementation into the Czech legal system is thus a welcome and necessary response to the expansion of cryptocurrency trading in the Czech Republic and the rest of the world.

Implementation of the MICA Regulation

Due to the principle of direct effect of the Regulation and the primacy of EU law, the Regulation will be enforceable without the need for its implementation into Czech law. However, the executive, legislative and judicial authorities will have to prepare for the EU regulation and incorporate it into their decision-making and legislative practice.

At the same time, it will be necessary to enable the exercise of rights and obligations under the Regulation, specifically the provision of a body that will ensure the granting of authorisations for the provision of cryptographic asset services, i.e. the CASP, which we discuss below in the article. In the Czech Republic, this authority will be the Czech National Bank, which is also apparent from the CNB's website, where it invites interested parties to obtain this authorisation.

MiCA in a nutshell

Objectives of the Regulation

- The aim of the MiCA Regulation is to adapt EU regulation to the digital age by enabling the use of innovative technologies in a future-ready economy.

- It aims to balance and regulate the cryptoassets industry at EU level without hampering the development of the underlying technology.

- The uniformity of EU rules will ensure legal clarity for the sector in the EU and will have a significant regulatory impact globally.

- A harmonised EU-wide legal system will impose its requirements on all actors in the cryptoassets sector within its scope.

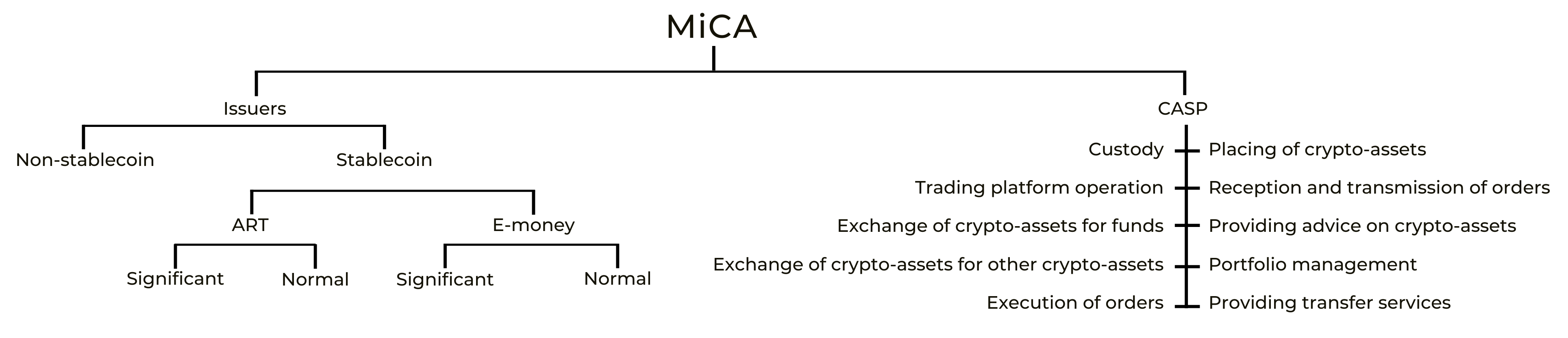

- The regulation divides market participants into crypto issuers and crypto service providers.

Scope of MiCA

| Crypto asset non-stablecoin

|

Issuers of cryptoassets

|

Cryptoassets service providers

|

| Utility Tokens

|

Cryptoassets

|

Exchanges

|

| Cryptoassets

|

Stablecoins

|

Wallet Providers

|

| Stablecoins

|

Swaps

|

|

| NFT etc. | Payment facilitators etc. |

The MiCA Regulation applies to all crypto-assets and crypto-market entities. Although some are either completely exempt or may be exempt under certain conditions.

Exemptions and exemptions

- NFT - Non-fungible tokens are completely excluded;

- Airdropped tokens - may be exempt under certain conditions;

- Mining/betting rewards - may be exempt under certain conditions; Utility tokens - may be exempt under certain conditions;

Key Definitions

- Issuers - issuers of cryptoassets, 2 basic types: stablecoins and non-stablecoins.

- Stablecoin - a crypto asset backed by other assets that maintains its stable value.

- Non-stablecoin - a crypto asset whose value can fluctuate depending on market conditions.

- CASP - Cryptoasset service providers that provide one or more of the services prescribed by MiCA.

- Electronic Money Tokens (EMTs) - FIAT-backed stablecoins that are equivalent to electronic money.

- Asset Referenced Tokens (ARTs) - stablecoins backed by any asset that is not equivalent to electronic money.

- Significant stablecoin - tokens that have a significant enough market presence to influence the financial market or prevent other issuers from issuing their stablecoins.

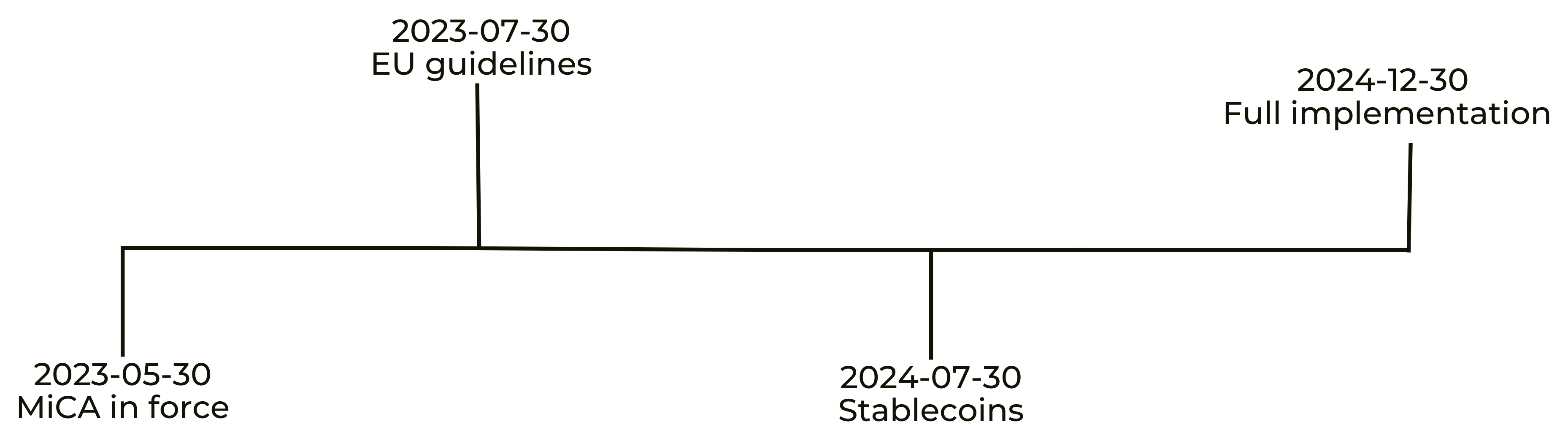

As the MiCA Regulation will be phased in gradually, the first phase is already in place from 2023 and the EU institutions are already in the process of drafting the necessary guidance explaining the implementation of the Regulation.

The first round of regulatory requirements, which will begin on July 30, 2024, will apply to the issuance of stablecoins, and the final phase on December 30, 2024, will apply to other crypto market participants. Accordingly, industry participants with less than a year to go before the Regulation takes effect should take full advantage of the transition period. This was reiterated by the EBA in its Crypto Market Statement for stablecoin issuers.

Key findings

- MiCA - implemented gradually

- Possible exemptions and exemptions

- EBA calls for preparation during the transition period of the Classification of Crypto Assets and Market Participants

- 2 types of stablecoins - EMT and ART

- 10 different services for CASP

In order to ensure a smooth transition, crypto market participants should familiarise themselves with the existing regulatory framework in their home Member State, which will remain in place during the transition period, and use the requirements of MiCA Regulation as a template for adapting their arrangements in line with the forthcoming regulatory regime.

Notwithstanding the narrow exemptions, all crypto issuers will be required to prepare a white paper that includes information on:

- Issuer;

- Project cryptoactivity;

- Token;

- Basic technology including environmental impact; Associated risks;

Stable coin issuance

MiCA distinguishes between two types of stablecoins - electronic money tokens (EMTs) and asset-linked tokens (ARTs). Although both have the same objective, i.e. to maintain a stable value pegged to the FIAT currency, the difference lies in the potential issuers and the underlying assets that support their value.

- ART - may be issued by any entity, if authorized to do so, and may be secured by any assets.

- EMTs - may only be issued by credit institutions or electronic money institutions, without having to be separately authorised, and may be backed by the FIAT currency to which they are linked.

- Once the issuance of stablecoins is authorised by a single EU regulator, issuers will have the right to issue them throughout the EU.

- Providing interest for holding stablecoins will be prohibited.

- Both stablecoins can be considered "significant" if, among other things, their daily transaction volumes and market capitalisation exceed a certain threshold.

Like most cryptographic activities, the issuance of stablecoins is heavily dependent on technology, so it is important to create not only a reliable, future-proof DLT infrastructure, but also one that is compliant with regulations and has the required tracking and reporting capabilities.

CASP Authorisation

The provision of any of the 10 crypto asset services is subject to authorisation by the competent authorities of the home Member State, i.e. in our case the Czech National Bank. The applicant entity must be a legal person or an undertaking established in the Member State in which it intends to carry out at least part of its activities. The information to be provided during the application process and the prudential requirements will depend on the services for which authorisation is sought.

General CASP permit requirements:

- Legal entity, business, other businesses providing equivalent level of protection as a legal entity;

- Established in the EU Member State in which it operates;

- Effective management in the EU;

- At least one of the directors resident in the EU;

- EU-wide authorisation;

- Different rules for already licensed entities;

- Clear description of activities;

- Genuine governance arrangements;

For more information contact us at:

ECOVIS ježek, advokátní kancelář s.r.o.

Betlémské nám. 6

110 00 Praha 1

e-mail: mojmir.jezek@ecovislegal.cz

www.ecovislegal.cz

About ECOVIS ježek, advokátní kancelář s.r.o.

The Czech law firm ECOVIS ježek focuses its practice primarily on commercial law, real estate law, litigation, but also finance and banking law and provides full-service advice in all areas, creating an alternative for clients of international law firms. The international dimension of the services provided is ensured by the experience gained to date and through cooperation with leading law firms in most European countries, the USA and other jurisdictions within the network ECOVIS operating in 75 countries around the world. ECOVIS ježek team members have many years of experience from leading international law and tax firms in providing legal advice to multinational corporations, large Czech companies, as well as medium-sized companies and individual clients. For more information please visit www.ecovislegal.cz.